.png)

| BITMORTGAGE®

www.bitmortgage.com

Celebrating at least 18 Years April 9, 2005 - April 9, 2023+ Managed by MQCC®: The Global Standard for Metaverse™ MQCC®: The Global Standard for BlockChain® MQCC®: The Global Standard for Crypto® BITMORTGAGE®: The World's Leading Registered Trademark Brand of Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Electronic Real Estate and Non-Real Estate Finance ("CryptoFinance") and Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Electronic Cash ("CryptoCurrency") Products and Services since at least as early as April 9, 2005.

---

Registered to the National Standard of 119 Countries. |

|

NOTICE: Annual World BlockChain Day™ and World Crypto Day™ celebrations and events occur, beginning on April 9, 2020. Visit www.WorldBlockChainDay.net and www.WorldCryptoDay.org to learn more and participate. Celebrate over 15 years of the Democracy-in-Finance® trademark brand of Systems, Technology, Services and Products. |

BITMORTGAGE® is a registered trademarked and brand of innovative financial products and services described as "Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow" electronic real estate and non-real estate financial products & services; mortgages, loans and investment securities via fiat and non-fiat digital electronic currency"; built in the world's first application of the MQCC™ trademark source identifier "Principles of 'BlockChain'™"-in-Commerce. The Systems, Technology, Services and Products were first made commercially available to the global public (consumers, government, academia and industry) on April 9, 2005 at www.privatelender.org.

Including:

MQCC™ AI MORTGAGE TOKENS™ including:

Fungible Token Mortgage: APPLICATIONS

NonFungible Token Mortgage: COMMITMENTS

NonFungible Token Mortgage: AGREEMENTS

NonFungible Token Mortgage: CERTIFICATES

NonFungible Token Mortgage: SECURITIES

Commercialized, Fully Functional, Global Regulatory-Integrated, Risk-Liability Insurable trading of Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow digital and non-digital, non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; unsecured or secured by real estate or other assets.

Anybody - in most global jurisdictions - can borrow, invest or lend or license the Bitmortgage® registered trademark brand financial systems, technology, services and products; and everyone can take part in one way or another. Visit country.mqcc.org to see your country (jurisdiction) in the MQCC Global Country Network™.

The term CRYPTO is synonymous with:

"Peer-to-Peer (P2P)/Private/Secret/Shadow"

Read origin.mqcc.org to learn more.

The compound term CRYPTOFINANCE (Financial Commerce) includes:

"CryptoDebt", "CryptoAsset", "CrytoLoan", "CryptoMortgage", "CryptoCurrency", "CryptoSecurity"; "CryptoTitle"

Read origin.mqcc.org to learn more.

MQCC™ Democracy-in-Finance® Trademark Brand of Systems, Technology, Services and Products

BITMORTGAGE® registered trademark suite of systems, technology, services and products brings the highest degree of democracy (freedom and equality) to global financial commerce, not seen in human history at any time earlier throughout civil society and organized global commerce.

MQCC™ Safety-through-Quality™ Trademark Brand of CryptoFinancial Products:

Since at least as early as May 9, 2008; MQCC™ (MQCC - Bungay International) is inventor, manufacturer and developer of the world's only ISO 9001:2015 registered, risk-based quality management subordinate-system (and related superordinate, subordinate and peer systems) for delivery of CryptoFinance-related financial instruments, which means that products and methods are "better, safer and more efficient".

Read www.mqcc.org to learn more.

All Conforming Fiat-integrated digital assets including OFFICIAL AUTHENTIC ORIGINAL™ OAO™ BITCOIN™ and CRYPTDO™: OFFICIAL CRYPTO OF THE METAVERSE™

and Non-Conforming, Non-Fiat-Integrated, High-Risk, Experimental and Volatile digital assets including:

MultiPlatform: ISO 4217-U Coded (and non-ISO) Fiat & non-Fiat (experimental) Non-conforming Crypto "currency": XBT, ETH, XMR, XRP, XZC, ZEC, AUR, POT, PPC, MSC or newer.

Email [email protected]

To Get a Quick overview for

Borrowers |

Investor-Lenders(Individuals, Corporations, Trust & Foundations) |

Licensed and Unlicensed Referral Parties |

BITMORTGAGE® Countries

BITMORTGAGE® Goods & Services

Licensing of MQCC™ Systems, Technology, Services and Products

New to Cryptocurrency? If you are interested in learning more about cyrptocurrency and related matters (bitcoins, blockchains), you may as well learn it correctly. Visit:

LearnItRightCrypto™.com |

"A True Financial Innovation"

"The Bitmortgage® brand of peer-to-peer real estate financial transactions, is a true financial innovation that transforms traditional real estate financing. A system of statutory, regulatory and process conformity which assures non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; unsecured or secured by real estate or other assets on a Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow basis and related systems, technology, services and products are effectively integrated with a peer-to-peer electronic cash system; while maintaining certifiable levels of regulatory conformity, privacy, security and trust, 'without going though a financial institution'; and with zero public market beta (volatility).

-Anoop Bungay, (Bitmortgage® Inventor) Founder, Bungay International Inc., MortgageQuote Canada Corp. (MQCC™)

BITMORTAGAGE® Innovation - Learn More

Beat or Bypass® the global, central banking systemBe the Bank® |

What Can You Do?

Borrow or Make Payments

Beat or Bypass® the global, central banking system

Invest or Lend

Be the Bank® - People Investing in People®

Intermediation (Brokerage)

Create a regulatory-integrated referral (brokerage) business without the direct operating risk.

Licence

The Democracy-in-Finance™ Trademark Brand Class of Systems, Technology, Services and Products to provide your customers with the MQCC™ Democracy-in-Finance™ brand of equality based, financial commerce solutions.

Commercial origination, manufacture, trading and intermediation of

Non-Bank, Non-Institutional, Non-Syndicated, Non-Regulated or Regulatory Exempt, Free Trading Finance; also known as Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Finance Securities in:

-

Classic Paper-based Document Format

-

Utility tokens including BITCOIN™ trademark brand utility token (and non-binary digit (cold) equivalent)

-

Securities tokens including BITMORTGAGE® trademark brand securities token (and non-binary digit (cold) equivalent)

-

Conformity tokens including BITCONFORMITY™ trademark brand conformity token (and non-binary digit (cold) equivalent)

-

Quality tokens including BITQUALITY™ trademark brand quality token (and non-binary digit (cold) equivalent)

-

Fungible tokens (FT); both binary digit and non-binary digit (cold) equivalent

-

Non-fungible tokens (NFT); both binary digit and non-binary digit (cold) equivalent

Regulatory tokens; both binary digit and non-binary digit (cold) equivalent

Artificially Intelligent Smart NFT Contracts (aiSMARTnft™); both binary digit and non-binary digit (cold) equivalent

Features

Secured by Real Estate, using Electronic Cash based upon an electronic payment system based upon cryptographic proof.

- Remove the intermediary

- Bypass the traditional banking system

- Protect yourself from fraud (lenders, borrowers, sellers, buyers)

- Establish & Maintain Privacy (Anonymity)

- Speed, Efficiency and Accountability

- Fully secured and insurable by title insurance companies including: First American Title (USA), First Canadian Title, First Title (UK-EU-AUS-NZ) and others.

- Fully compliant with the world's first national digital currency law (a blueprint for other countries) and government financial oversight entities, including Bill C-31/PCMLTFA & FINTRAC (Canada).

- Multi-Platform Integration:

- Non-Fiat Currency: Bitcoin, Ripple, Ethereum, LiteCoin (or whatever recognized (ISO 4217U Coded or non-ISO) platform you prefer)

- Fiat Currency: MintChip (Canadian Currency); no longer available in its original form.

- Trust the power of MortgageQuote.ca's (MQCC™) certified Integrated Quality Management Systems (iQMS™) Technology.

By integrating the MQCC™ BITMORTGAGE® registered trademark brand of the cryptomortgage class of cryptofinancial product with various approved cryptocurrency, you enjoy all of the benefits of trading in non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; unsecured or secured by real estate or other assets on a Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow basis; combining binary digit "cryptocurrency" (electronic payment system), merged with a binary digit "cryptofinance" (electronic finance system) both of whom bypass traditional third-party banking or regulatory (or both) systems; enveloped in the safety of a subordinate Quality Management System that assures National and International standards-level of statutory, regulatory, process (SRP™) conformity.

Safe, Private, Anonymous, Secure.

The MQCC Standards are trusted by governments and regulators all around the world. Visit country.mqcc.org country.mqcc.org to learn more.BITMORTGAGE® Brand Definition: Control of Character & Quality

The BITMORTGAGE® registered trademark is a brand name used to identify and distinguish the goods/services of Bungay International Inc. (licensed to MortgageQuote Canada Corp. MQCC™) from others, and to indicate the source, namely, MortgageQuote Canada Corp. MQCC™, of the goods/services, namely, peer-to-peer (& private) real estate financial products & services; mortgages, loans, investments via fiat and non-fiat digital, cryptocurrency.

- Greater safety in a Semi-Closed System versus Open System. Unlike the subordinate 2008 distraction genericized named 'bitcoin' Satoshi Nakamoto System [a later-created (by six (6) years); Alpha experimental system that the 'world' has been lured to] nn open system where anyone can establish a "bitcoin (cryptocurrency) business" (or use the "Peer-to-Peer Electronic Cash System") the originating 2005 Anoop Bungay System is a semi-closed system, which assures certifiable levels of internationally-accepted quality management standards are met, resulting in safety, efficiency and accountability for legislators, regulators, regulatees, customers, prospective customers and other interested parties.

- Central quality management Global Network Administrator: MortgageQuote Canada Corp. (MQCC.org™).

- The Global Network Administrator assures that there is ongoing direct or indirect control of the character or quality of the wares or services in association with which the Bitmortgage® brand and related Bitmortgage® brand trademark(s), registered or unregistered, in use or intended to be used; either directly or indirectly, under license.

- Through use of technology and proprietary algorithms, the Bitmortgage brand of peer-to-peer real estate financial products, represents the highest levels of quality creativity, flexibility, efficiency, safety and accountability that can be delivered to the global finance community, unmatched by others.

- Pursuant to Canadian, US and international legislation: "The owner of the registered trademark BITMORTGAGE® has direct or indirect control over the character or quality of the goods or services in respect of which the trade-mark is used."

MQCC™ Democracy-in-Finance® Trademark Brand of Systems, Technology, Services and Products

Democracy-in-Finance™ trademark brand of MQCC™ Systems, Technology, Services and Products

Within the BIT-BRAND™ global primary trademark class, the BITMORTGAGE® registered trademark subordinate brand-class suite of systems, technology, services and products brings the highest degree of democracy (freedom and equality) to global financial commerce, not seen in human history at any time earlier throughout civil society and organized global commerce.

Anybody - in most global jurisdictions - can borrow, invest or lend or license the Bitmortgage® registered trademark brand financial systems, technology, services and products; and everyone can take part in one way or another. Visit country.mqcc.org to see your country (jurisdiction) in the MQCC Global Country Network™.

A Brief History of Regulatory-Integrated, Global Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Electronic Real Estate and Non-Real Estate Finance (CryptoFinance) and Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Electronic Cash (CryptoCurrency) Systems, Technology, Services and Products

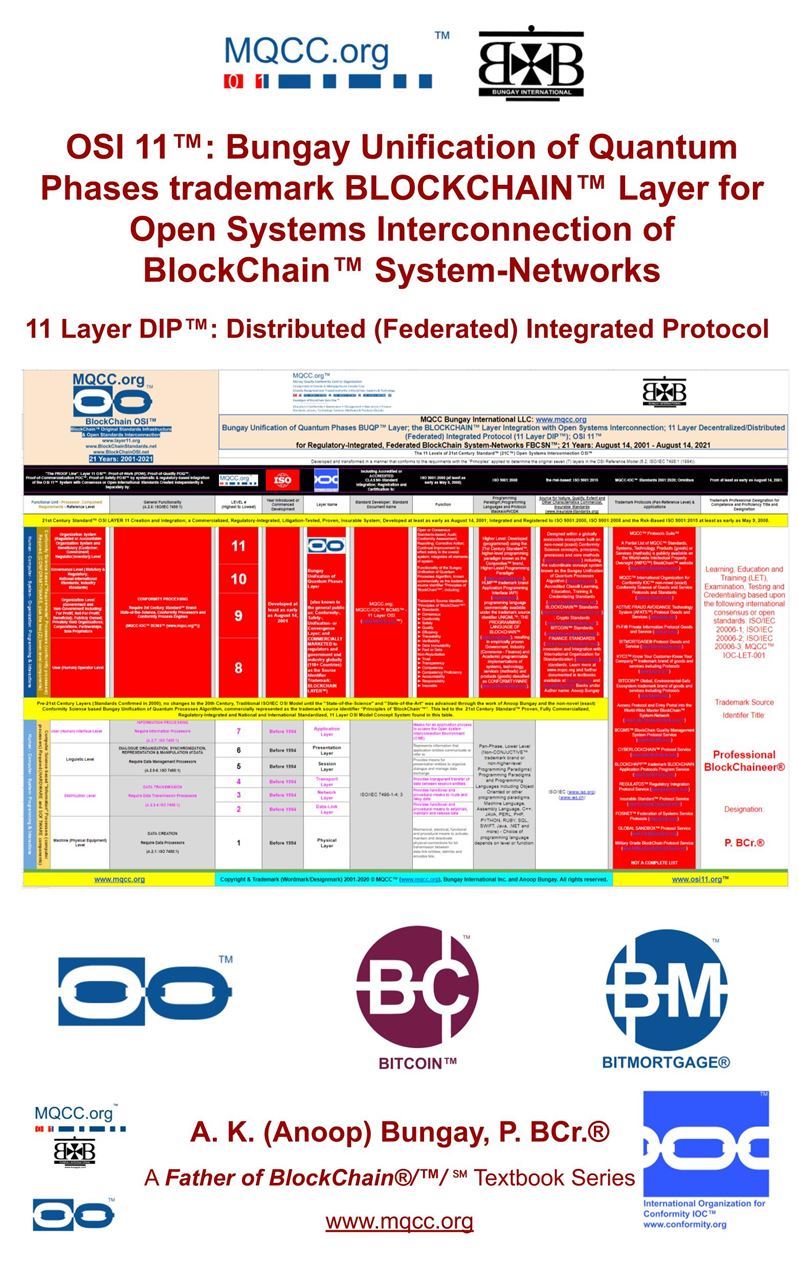

The BITMORTGAGE® registered trademark brand is an "individual (subordinate class) brand" of systems, technology, services and goods (products) within the BIT Brand™, superordinate brand class of systems, technology, services and products; solely developed and produced pre-April 9, 2005 by Mr. Anoop Bungay and Bungay International Inc. (BII™); collectively developed and produced post-September 16, 2006, in collaboration with MortgageQuote Canada Corp. (MQCC™). Since at least as early as May 9, 2008, all MQCC™ BIT Brand™ systems, technology, services and goods (products) are delivered within an ISO 9001:2015 registered, globally accessible, regulatory-integrated, decentralized, autonomous, rules-based, standards-based, federation of system network (MQCC™ FOSNET™) that has implemented the latest version of the seminal MQCC™Meta Operating System (MOS™), a risk-based, organization conformity operating system designed for decentralized autonomous organizations (DAO) built on the pioneering "Bungay Unification of Quantum Processes Algorithm" also represented as the trademark "Principles of 'BlockChain'™" or the simplified compound term: "BlockChain", within a regulatory-integrated, finance business model. Including seminal Systems-Level (SL)/Systems-Learning (SLr) Artificial Intelligence (2SL-AI™) principles, first observed, formalized and commercialized by Mr. Anoop Bungay between 2001 and 2008); and first promoted publically on twitter on May 1, 2019 (https://twitter.com/mymortgagequote/status/1123798397947920392) #SystemsLevelAI; #SystemsLearningAI

Read origin.mqcc.org to learn more.

BITMORTGAGE® & BIT Brand™: Family Brand and Individual Brands

The "individual (subclass) brand" name BITMORTGAGE® is a distinctive, unitary word that was created out of the technical phrase: "binary digit mortgage", a term that is synonymous with the compound terms: "electronic mortgage" and "crypto (Peer-to-Peer (P2P)/Private/Secret/Shadow ) mortgage".

- Pursuant to World Intellectual Property Organization, Canadian Intellectual Property Organization, United States Patent and Trademark Office and the 117 participating countries pursuant to the Madrid Protocol standards, the brand name BITMORTGAGE® functions as a trademark and source identifier of Bungay International Inc.'s (MQCC Bungay International LLC), systems, technology, services and goods (products). The BITMORTGAGE® registered trademark brand represents a brand class that subordinate of the BIT Brand™ class.

The "family (class) brand" name BIT Brand™ is a distinctive, compound term that was created out of the terminological phrase: "binary digit brand".

- Pursuant to World Intellectual Property Organization, Canadian Intellectual Property Organization, United States Patent and Trademark Office and the 117 participating countries pursuant to the Madrid Protocol standards, BIT Brand™ functions as a trademark and source identifier of Bungay International Inc.'s (MQCC Bungay International LLC) systems, technology, services and goods (products). The BIT Brand™ trademark brand represents a brand class that is superordinate to the BITMORTGAGE® registered trademark brand class.

Early Years of Development

August 14, 2001 until April 8, 2005: "First Observation, then the System, Technology, Services and Products"

The underlying technology (defined as techniques, skills, methods and processes) that created the binary digit mortgage or electronic mortgage was originally conceptualized and developed by an individual named Mr. Anoop Bungay, at least as early as August 14, 2001. Soon after the point of creation of the binary digit mortgage or electronic mortgage or cryptomortgage "technology", Mr. Bungay determined that continued development would be irrelevant unless a corresponding "system" was created to ensure that the highest standards of statutory, regulatory and process (SRP™) requirements could be achieved on the brand principles of "Continuous Conformity™" or compliance.

- On August 14, 2001; Anoop Bungay became licensed in the jurisdiction of Alberta, Canada, to trade in regulated and free-trading financial securities secured by real property.

- On November 7, 2002 development was incorporated under the aegis of AB Global Inc., a company incorporated in Calgary, Alberta, Canada. On January 28, 2003, AB Global Inc. changed its name to Bungay International Inc.

- By April 8, 2005 a functional system to effect "continuous conformity™" was created and integrated with the technology to create and distribute binary digit mortgages or electronic mortgages. With Alpha testing concluded, the beta version of the regulatory-integrated, functional global network and system was common-law trademark branded (and subsequently registered as a trademark) as "PrivateLender.org: Canada's Private Lending Network®".

- On April 9, 2005, the fully commercialized functional system, "PrivateLender.org: Canada's Private Lending Network®" was brought on-line for service to Canadian and International customers, within "approved jurisdictions". The functional system was managed by Bungay International Inc. and marketed directly (on a first-party basis) and indirectly (on a third-party basis) by independent "agents, associates and sub-brokers" who are contracted to (or employees of) "approved government licensed- and licensed-exempt, brokerage (origination) firms that trade in real-estate secured and non-real estate secured financial securities (instruments)".

-

- "Approved Jurisdictions" are defined as: geographic regions where a license to trade in real-estate secured or non-real-estate secured financial (debt/asset) instruments may or may not be required.

April 9, 2005 until Today: "Proof of Efficacy through Registration to International and National Standards & Continuous Conformity™"

Between April 9, 2005 and today, Bungay International Inc. continues to develop pioneering principles know in commerce by the trademark source identifier "Principles of 'BlockChain'™" brand of finance systems, technology, services and goods (products).

- On September 16, 2006, management of the functional system named "PrivateLender.org: Canada's Private Lending Network®" was incorporated into MortgageQuote Canada Corp. (MQCC™).

- On May 9,2008, the MortgageQuote Canada Corp. (MQCC™) earned a "Certificate of Registration" which validates that it operates a Quality Management System which complies with the requirements of ISO 9001:2000 (and subsequent ISO 9001:2008) for the scope of mortgage brokerage services.

- On May 9, 2014, the MortgageQuote Canada Corp. (MQCC™) earned a "Certificate of Registration" which validates that it operates a Quality Management System which complies with the requirements of ISO 9001:2015 for the scope of mortgage banking and mortgage brokerage services.

- Visit www.mqcc.org to learn about the importance of "Continuous Conformity™"

MQCC™ BlockChain-in-Finance: CryptoFinance: "Proof of Efficacy through Registration to International and National Standards & Continuous Conformity

At least 6 months prior to introduction of the child (subordinate) "cryptocurrency" system was introduced to the "world", the BITMORTGAGE® brand of "Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Real Estate and Non-Real Estate Finance (CryptoFinance) and Peer-to-Peer Electronic Cash (CryptoCurrency) Products and Services" and its related technology (techniques, skills, methods and processes) was registered to the internationally trusted, consensus quality management system named ISO 9001:2000 on May 9, 2008.The Originating BlockChain; the Originating Standards

The world's first commercialized trademark source identifier "Principles of 'BlockChain'™ -brand based business (the Originating BlockChain) can be described as: "A Peer-to-Peer Electronic Finance System" in order to "allow online secured and unsecured financial instruments to be arranged directly from one party to another without going through a financial institution". A semi-closed system built built on the pioneering "Bungay Unification of Quantum Processes Algorithm", commercially identified by the trademark source identifier brand name: "Principles of 'BlockChain'™" or the simplified compound term: "BlockChain"; requiring first, second or third-party access permission; with public no-permission extensions; with regulated anonymity and in-built quality management validation; and related technology developed between pre-2005 (at least as early as August 14, 2001) and May 8, 2008. The system's statutory, regulatory and process (SRP™) safety, integrity and efficacy was proved through certification of conformity publicly published by registration to the National Standard, National Defense Standard and International Standard for Quality Management Systems of Canada, USA, UK , up to 119 countries on May 9, 2008; by A. K. (Anoop) Bungay. The MQCC system utilizes a hybrid of Systems-Level/Systems-Learning artificial intelligence or SL-AI; using principles and standards first developed by Anoop Bungay; the "Father of System-Level (SL)/Systems-Learning (SLr) AI" or 2SL-AI™.Originating BlockChain (or BlockChain Zero One™); a "Private Hybrid BlockChain" with Semi-Closed System:

Initiated pre-2005 and functionally developed in 2007, the "private hybrid BlockChain" system and and related technology - and Private Hybrid BlockChain Standards - was developed by Anoop Bungay, Founder of Bungay International Inc. (the original commercial entity) and MortgageQuote Canada Corp. (MQCC™), a finance sector organization based in Canada. To ensure that internationally recognized certifiable levels of the highest standards of safety, reliability and good quality are maintained (for the benefit of legislators, regulators, customers, prospective customers and other interested parties in 119 countries for what is a non-regulated financial transaction (Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow finance); MQCC™'s private hybrid BlockChain, semi-closed system and technology has the distinction of being the worId's first (and only) to be continuously certified from May 9, 2008 to present-day, to the internationally recognized consensus-based quality management system published by the International Organization for Standardization (ISO), namely, ISO 9001:2000, ISO 9001:2008 and ISO 9001:2015 for BOTH hot (binary digit/electronic) and cold (paper-based) financial transactions of a Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow nature. To distinguish and establish source identification, the Originating Bungay BlockChain Algorithm is also trademarked as "BlockChain Zero One™".

- Generically, the Anoop Bungay System produces goods and services in the form of, or related to: "peer-to-peer electronic debt/asset or 'binary digit debt/asset'" or Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow electronic/binary digit assets/debt.

RESEARCH PAPERS/THESIS/DISSERTATION:

Not required; the MQCC™ is mature; with over 15 years of globally accessible commercialization and continuous registration to ISO 9001:2015 since at least as early as May 9, 2008.

For the record: See below section called: Some more details and some books.

The Future of Finance Started on April 9, 2005.BITMORTGAGE® functions within the MQCC™ system. MQCC™ is the only Canada-based finance sector firm whose risk-based unified Quality Management System (uQMS™) is certified to meet the rigorous 'National Standard of Canada' for Quality Management, published by the CSA Group (Canadian Standards Association). The Standard is trusted by Canadians and recognized by over 119 countries including USA, UK & AU.

Safety through Certified Levels of Quality (Safety-through-Quality™)Systems Certification to International Quality Management Standards"This product or applicable management system complies with ANSI ISO 9001:2015 standard, with CAN/CSA-ISO 9001:16 standard, with AS/NZS ISO 9001:2016 and is certified to ISO 9001:2015 standard." Visit the Global Network Administrator page to learn more about Safety through Certified Levels of Quality. International Concordance & Standards Development OrganizationsSystems Certification to International Quality Management Standards"This product or applicable management system complies with ANSI ISO 9001:2015 standard, with CAN/CSA-ISO 9001:16 standard, with AS/NZS ISO 9001:2016 and is certified to ISO 9001:2015 standard." Including high-quality international standards and guidance from other standard-setting boards.

Systems Certification to International Blockchain Conformity Standards "This product or applicable conformity system is registered to the IOC MQCC:BCMS standard."

|

Some more details and some books.

Early Years:

A Brief History & Future of the Development of Global “Crypto-, Peer-to-Peer (P2P), Private, Secret & Shadow” Binary Digit Finance (BIT™ Brand Suite: BITFINANCE™, BITDEBT™, BITASSET™ BITMORTGAGE®), BlockChain & Conformity: Systems, Technology, Services and Products

By: Bungay International Inc., MortgageQuote Canada Corp., Money, Quality, Conformity, Control Organization (MQCC™) & Mr. Anoop Bungay; ([email protected]), Founder, Bungay International Inc. (www.bungays.com) and MortgageQuote Canada Corp., Money, Quality, Conformity, Control Organization (MQCC™) (www.mqcc.org).

Inventor of the BlockChain-based system and related technology (principles, processes, nomenclatures, applications of science) for ensuring integrity of digital financial functions, financial processes and financial records.

Developer of the World's First Peer-to-Peer (P2P), Private & Cryptolending Network, for regulated and non-regulated transactions, in a system registered to the National and International Quality Management Standards of 119 countries.

NOTICE: This is a "PRIMARY SOURCE DYNAMIC DOCUMENT™” documenting historical and current primary source information. Changes are made on an “ongoing basis”. This document is published by Anoop Bungay, Bungay International Inc. (BII™) and MortgageQuote Canada Corp. (MQCC™) as a matter of historical, commercial and intellectual property record. Calgary, Alberta, Canada.

You may need to register to request access to this document.

A Brief History & Future of the Development of Global “Crypto-/Peer-to-Peer (P2P)/Private/Secret/Shadow” Binary Digit Finance (BIT™ Brand Suite)

BITFINANCE™, BITDEBT™, BITASSET™, BITMORTGAGE®), BlockChain & Conformity:

Systems, Technology, Services and Products: August 14, 2001 to

Present Day

By: Bungay International Inc., MortgageQuote Canada Corp., Money, Quality, Conformity, Control

Organization (MQCC™)

& Mr. Anoop Bungay; ([email protected]), Founder, Bungay International Inc. (www.bungays.com) and

MortgageQuote Canada Corp., Money, Quality, Conformity, Control Organization (MQCC™) (www.mqcc.org).

Inventor of the blockchain-based system and related technology

(principles, processes, nomenclatures, applications of science)

for ensuring integrity of digital financial functions, financial processes and financial records[1].

Developer of the World's First Peer-to-Peer (P2P), Private & Cryptolending Network, for regulated

and non-regulated transactions,

in a system registered to the National and International Quality Management Standards of 119 countries.

Table of Contents

For the definition of “BlockChain” please click

here to get to the “definition of BlockChain” section of this document. 9

MQCC™ Document Introduction 10

MQCC™ Document Classification 12

Development of MQCC BIT™ Brand Suite of Binary Digit Financial, MQCC BlockChain™ and

Conformity Systems, Technology, Services and Products 13

Formal Ontology, Methodology, Analysis, Linguistics

(Word Formation, Phonetics, Taxonomy, Nomenclature); Reference Architecture, Systems Architecture

Description: Ingredient, Quality, Characteristic, Function, Feature, Purpose,

or Use; Concepts, Meanings, and Interpretation 13

Introduction Conformity Science; A New Field of Study, A New Academic Discipline 15

Introduction to “Crypto/Peer-to-Peer (P2P)/Private/Secret/Shadow” Binary Digit Finance:

“Origin of the Binary Digit Specie™” 16

Definition of the term: “Crypto” 18

Introduction to the MQCC BlockChain™ 19

The system & technology needed to create the services & products 19

How the Combined Term (Composite) “BlockChain” was Formed: Death of a Trademark,

Definition of the term (composite, unitary word) “BlockChain” 21

The basic definition of the combined term (composite, unitary word) “BlockChain” was coined

[based upon by Ontological,Linguistic and

Lexicographic principles] by Anoop Bungay founder of MortgageQuote Canada Corp. MQCC™ as:

History, Origin (etymology) & Construct of the term (composite, unitary word) “BlockChain” 22

Application of the term (composite, unitary word) “BlockChain” during Implementation 23

Private Trademark or Public Definition 24

MQCC BlockChain™ Principles 25

Introduction to the MQCC BIT™ Suite of Brands: BITFINANCE™, BITASSET™, BITDEBT™,

Classes of Binary Digit Financial Instruments 26

Family-Class Brand and Individual (SubClass) Brand Names & Related Trademarks 30

BITMORTGAGE® Brand - Additional Definition 34

Mortgage Goods and Services 34

Debt/Asset Goods and Services 34

Logical Relationship between Mortgage and Assets/Debt 35

“Crypto-/Peer-to-Peer (P2P)/Private/Secret/Shadow” Activity: Generally

Accepted Definitions & Character 36

Crypto-/Peer-to-Peer (P2P)/Private/Secret/Shadow lending consists of two viewpoints:

Borrower and Investor-Lender 37

Early Years of Discovery and Development 40

August 14, 2001: “Anoop Bungay - Binary Digit Debt/Asset: A Peer-to-Peer Electronic Finance System” 40

"First the Product & Service, then Technology, then System" 40

November 7, 2002: Bungay International Inc. (BII) 40

September 16, 2006 - MortgageQuote Canada Corp. (MQCC™) 42

Necessity is the Mother of Invention (August 14, 2001 - May 8, 2008) 43

"Private Hybrid BlockChain" 43

May 9, 2008 until Today: "Proof of Efficacy through Registration to International

and National Standards & Continuous Conformity" 44

October 2008: “Satoshi Nakamoto - Bitcoin: A Peer-to-Peer Electronic Cash System” 45

, crypto (private) mortgage/asset/debt" with

"binary digit currency, electronic cash, crypto (private) currency" 46

Resulting Post-Integration Outcome 47

Generic Contrasting Definitions 47

May 9, 2008 and Onwards: MQCC: Developer of World’s First Higher-Order Artificial Intelligence (AI)

System Built on BlockChain Technology 48

Implementation Method; Deployment Protocol 49

Comments re: Primary Research Papers 50

Selected Anoop Bungay Papers 51

Definition of Inventive Claim Components 52

Public Disclosures & Comments - FAQ’s 53

Government, Regulator and Industry Member Letters 53

Frequently Asked Questions (FAQ’s) 53

Some Books are Written:

Source: origin.mqcc.org

Welcome to the public disclosure of the world's first body of required reading for ALL duly appointed, lawfully elected or employed persons in public office or in private enterprise, as leaders; legislators, policymakers; regulators; technical experts; scientists; members of Top Management; global professional liability insurers including corporate risk insurers; legal professionals; law enforcement; and business persons; promoters; consultants; investors; students - in at least 119 countries - who seek primary source, traceable, verifiable and immutable knowledge on the origins, commercialization, litigation-testing and National and International Standardization of the "Principles of 'BlockChain'" and related concept system subject matter: including but not limited electronic peer-to-peer finance (non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading; (P2P)/Private/Crypto/Secret/Shadow) utility tokens, securities token.

This global public disclosure is designed to be your practical and scholarly, primary source knowledge commencing from at least as early as 14-August-2001 until present day (September 2019 - or as of latest update) on the origin of the "Principles of 'BlockChain'" and related concept system matter; and is designed to be relied upon as a legislative-, regulatory-, public policy-making-, academic-, business-, investment- , professional-, technical-, and scientific reference, now and into the future.

As an electronic - (intellectual property token; trademark brand: MQCC InPUT™ ) - format encyclopedic authoritative reference, this First Edition will be continually improved until the next edition is published.

If you are a lawfully elected or duly appointed public official (Head of State, Senator, Minister, Legislator, Policy Maker, Regulator); lawfully elected, duly appointed or employed member of a regulated, reporting or private organization in the role of Top Management (Chief Executive Officer (CEO)- level or Board of Director-level) member; a legal professional; an professional liability insurance/organization risk underwriter; an investor, academic or interested person: before you spend any of your personal money (or any more personal money) and your valuable personal time on 'BlockChain'-anything or 'crypto'-anything; put this electronic reference [intellectual property utility token (distinctively known as the MQCC™-registered, global trademark: MQCC InPUT™)] in your personal library and learn directly from the person (Author) who:

<*> first identified and commercialized (starting at least as early as April 9, 2005) a globally accessible, peer-to-peer electronic finance system; (cryptofinancial network).

<*> first registered (starting at least as early as May 9, 2008) a subordinate Quality Management System to ISO 9001:2000; ISO 9001:2008 and the current risk-based ISO 9001:2015 in order to publicly prove to "the world", that the globally accessible system-network methods and products are better, safer, more efficient and in order to establish at-a-glance (prima facie) levels of trust - at a global scale;

<*> Over the past 19 years, has personally introduced and educated the following classes of people on the origins and over-14 years of successfully commercialized, National and International consensus-standards-based, application the overarching concept system including: the "Principles of 'BlockChain'; utility tokens, securities tokens, conformity science:

*> public officials (Ministers, Legislators, Policy Makers, Regulators)

*> lawyers employed by law enforcement agencies

*> lawyers employed by public market securities regulators

*> CEO's, Executive Officers, members of Top Management of regulated, reporting or private business organizations

*> retail customers (investors and investees)

*> and more

<*> Developed, what is today, the world's most trusted and trustworthy global system-network of its kind that, for over 12 years, meets and exceeds United States a (US) Department of Defense (DoD), General Services Administration (GSA), and the National

Aeronautics and Space Administration (NASA) Higher-level contract quality requirements and integrates elements of the globally trusted US National Institute of Standards and Technology (NIST) Framework Core for Improving Critical Infrastructure Cybersecurity.

This encyclopedic authoritative reference takes you from the start, from at least as early as 14-August-2001 to Present day (September 2019). Now that this compendium is published, if any consultant or business promoter, anywhere in the world (at least in 119 countries where ISO 9000 is considered a National Standard class of family of standards) on matters claims to know what he or she is talking about and has not proven to you that they have read this important work of public disclosure, then they really don't know scientific-based, historically-accurate, information timeline.

-> Learn how the Author has been telling CyrptoExchange CEO's to learn the MQCC Standards™, so they can make their cryptoexchanges better, safer and more efficient for the inexperienced global public and regulatory community -- months (and years) before sad events occurred when some exchanges suffered catastrophic shutdowns because Top Management did not have and still do not have, the historically proven systems that they need to assure better, safer and more efficient cryptofinancial operations; which MQCC developed.

--> Learn how some CEO's or Top Management of Banks and Public Securities Exchanges have been explained that an over 14 year-old fully functional system built on the "Principles of 'BlockChain'" exists and will prevent corporate shareholder financial loss caused by risk due to uncertainty created by nonconformity events like mortgage fraud and ineffective public (reporting securities issuer) company operators.

-> Learn how a proven regulatory-integrated framework of co-existence between public securities regulators and non-public securities regulators and regulatees has evolved since at least as early as August 14, 2001.

-> Learn how the term Bungay Unification of Quantum Processes Algorithm also represented as the "Principles of 'BlockChain'" was abstracted from observation of the originating object or phenomenon.

-> Learn how to find out who is a competent consultant and who is not a competent consultant on matters related to the "Principles of 'BlockChain'"

-> Learn how to the global community has misunderstood the origins and wasted (in some cases, literally) millions of dollars in ideas that are "BlockChain-in-Name-Only".

-> Learn how "The Principles of 'BlockChain'" have nothing to do with computer programming language C++; which was used to program the bitcoin, alpha-state, experimental software program.

-> Learn about the discovery and commercialization of SYSTEMS-LEVEL Artificial Intelligence (SL) by the yours sincerely.

-> Learn how commercially available suite of systems, technology, services and products work for any size organization: 1 owner-operator to an organization with 1,000,000 million employees and more.

This encyclopedic authoritative reference will be your best investment in this subject matter, ever.

More about this encyclopedic authoritative reference

The "Principles of 'BlockChain'" were naturally discovered out of a need to create a governance and operating system for the world's first "peer-to-peer (P2P) electronic finance system-network" for the trade in non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; commencing from at least as early as August 14, 2001. As a reminder, before you invest or spend any money on "BlockChain"-anything, or "crypto"-anything; learn from from the person who first discovered and then commercialized it, since at least as early as April 9, 2005 at www.privatelender.org; a person who also happens to be the world's leading authority on National and International Standards-Class NISC™ (in at least 119 countries), Quality Management System-integrated, regulatory-integrated, litigation-tested, BlockChain-based Systems, Technology, Services and Products.

WARNING: If you have any question of comprehension or understanding, seek professional counsel before you - another friendly reminder - spend even one more unit of fiat currency ("real" money) on any "BlockChain" or "Crypto" project. Ask your local legislator, lawyer or, in the future your local conformity scientist and PROFESSIONAL BLOCKCHAINEER™/® the P. BCr.® Designation and the Chartered PEM® Designation (www.peminstitute.org); PEMI® Private Equity Mortgage/Electronic Money, Institute. Remember this authoritative encyclopedic reference is written by the person who developed the world's first commercialized an application of the "Principles of 'BlockChain'" in Commerce for a peer-to-peer electronic finance system. A body of transmundane knowledge encompassing a variety of knowledge disciplines. Having built "it" first and having built "it" right, means - despite being the CEO of a commercial finance sector organization - the Author is more or less "under the radar" from the scrutiny of the general public due to successful application of the sub-principle "effective disintermediation"; as such, nobody on Earth has really been afforded an opportunity to "look behind the history" - in a single, primary source compendium - to see how delicate, comprehensive, complex and beneficial conformity science and the "Principles of 'BlockChain'", truly are. Not to mention the painstaking diligent years of maintaining the momentum.

If you, your family, your company or your country is even "thinking" about investing limited sovereign resources and valuable time into the "Principles of 'BlockChain'", "crypto"-anything, "token"-anything and related matters (or want to be an authority on the subject), then learn about its origins, its regulatory-scrutinized, litigation-tested commercial applications of the present-day, and its future. Especially if you are (or will be, one day) employed as a Head of State, Legislator, Policymaker, Regulator, Lawyer, member of "Top Management" (Chief Executive Officer (CEO) or Board Member of a regulated or non-regulated Organization, Academic (student, undergraduate, graduate, doctoral, post-doctoral research), Journalist, Professional Liability Insurer, Investor, Head of a Family Office; or, if you are your normal, everyday person, just curious about the world.

This work of scientific-commercial-regulatory-financial literature is both a public service and an introduction to the foundational body of knowledge that led to the discovery of the "Principles of 'BlockChain'", the birth of binary digit non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; also known as Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow securities and related financial instruments; Binary Digit Financial Instruments or Digital Assets and the Discovery of Conformity Science. It is the foundation of evolutionary digital commerce (a new field of science for the study of the evolutionary (revolutionary, perhaps?) processes related to the discovery of the "Principles of 'BlockChain'" and production of binary digit financial instruments (digital assets), systems, technologies, services and products. The body of evidence - as you would expect from the creator of a system built on principles that creates trust through transparency, immutability, validation, traceability and verifiability - is itself, traceable, verifiable, immutable and transparent. You will not find this content anywhere else. MQCC is the point of origination.

The Bungay Unification of Quantum Processes Algorithm: when Quantum Unification Theory met Commerce. A revolutionary paradigm shift in how commerce is transacted, allowing for realizable quality, conformity and control goals to be achieved; resulting in long term, sustainable inflows of money. And lots of it.

If you agree that the "Principles of 'BlockChain'" offer the utmost level of immutable data (knowledge) veracity, validity, verifiability, transparency, proof and truth; then you will understand the non-trivial implications of this history of the discovery of the "Principles of 'BlockChain'".

Origin of a Specie™: an authoritative encyclopedic reference that only the discoverer of the world's first globally accessible, regulatory-recognized, regulatory-integrated and regulatory-trusted, commercialized "Principles of 'BlockChain'"-based system for the trade in non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; also known as Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow securities and related financial instruments (Binary Digit Utility Tokens for Digital Assets), could write.

Source: safer.mqcc.org

April 9, 2005: Global access to the world's first commercialized "Principles of 'BlockChain'"-based Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Finance system-network starts here and now.

While scientists may argue about what came first, the chicken or the egg; in cryptofinance, there is no doubt: the cryptomortgage (cryptoasset/cryptodebt) financial instrument developed by A. K. (Anoop) Bungay, Founder of Bungay International Inc. whose mature, "system-network" commenced commercial operations at the internet domain name www.privatelender.org® registered by Santosh Bungay on April 9, 2005; predates the experimental, alpha-stage, subordinate "Satoshi Nakamoto"-designed payment transfer (cryptocurrency) program introduced to the public on January 8, 2009, by nearly 4 years.

Whose Library Should this Book be in?

Complimentary (free) high-level information regarding the subject matter related to the MQCC SAFER™ Peer-to-Peer (P2P)/Private/ Crypto/Secret/Shadow Finance: "Private Lending" program for:

--> Global General Public (Interested persons)

--> Prospective MQCC Customers (applicants and borrowers)

--> Students (grade school/matriculation level)

Is Available at the website address: safer.mortgagequote.ca. You do not need to purchase this book in order to get an excellent understanding of the subject matter, at a high-level. And, if you, as a consumer, student or interested person desire more information, you are always able to visit www.mqcc.org and read the website for further complimentary (free) information.

This book should be in your library if you are employed (or will be employed) in at least one of the following roles:

>> Investors

>> Lenders

>> Legislators

>> Regulators

>> Liability Insurers

>> Lawyers

>> Regulated Broker

>> Professional of any other discipline where you feel that this content may be of help to your understanding of this new class of knowledge and commerce.

About the Book:

Less than one percent (<1%) of total Canadian and global financial trade is in cryptofinancial instruments. Before you invest your hard-earned dollars. limited sovereign resources or private equity capital into a field that is not well-known (and in many cases, misunderstood), if you are a:

>> Active Retail finance investor seeking zero-beta (non-public market systemic risk) investment opportunities

>> Prospective borrower or capital seeker looking for investor-lender funds

>> Chief Executive Officer (CEO) of a federally or non-federally regulated financial institution

>> Governor of a Central Bank; or other finance sector leader, policy-maker

>> Regulated professional in one of the many finance sector industry groups

Take the time to invest in your knowledge by learning first-hand from the developer of the world's first regulatory-recognized, regulatory-trusted, globally-accessible cryptofinancial system-network which complies with the United Nations (UN), World Trade Organization (WTO) and Organisation for Economic Cooperation and Development (OECD) best practice.

A globally accessible system-network with an Organisation for Economic Co-operation and Development (OECD)-recognized, National and International Standards-Class (NISC™) transnational private self-regulatory control system to safeguard network members and non-network users; and celebrates 14 years of successful regulatory-integrated operations on April 9, 2019. A system-network that set the defacto global standard for consumer-centric cryptofinancial systems; is successfully litigation-tested by some members of the International Council of Legal Regulators (ICLR) and serves as a proven template for individuals, organizations and countries who seek to model their own success and establish high-levels of global consumer confidence as leaders in global cryptofinancial trade, in their own right.

MQCC™ Money Quality Conformity Control Organization, incorporated as MortgageQuote Canada Corp. MQCC.org™ is Global Network Administrator (GNA™) of the world's first application of the "Principles of 'BlockChain'"-in-Commerce for a Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow electronic finance systems. Developer of National and International Standards-Class (NISC™) risk-based conformity management systems, technology, services and products that meets or exceeds regulator field examination compliance standards for “higher risk and critical, complex or high value financial activities, methods and products”.

ABOUT THIS BOOK: the MQCC SAFER™ (Sustainable, Accountable, Flexible-Fair-Fiduciary, Efficient, Regulated-Respectful-Realistic; SAFER™) Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Finance "Private Lending" Edition Program book will give you insight into the origins of cryptofinance; the results of over 14 years of successful operation; and factors to consider when getting involved in matters related to cryptofinance generally and "private lending" in particular.

Long term organizational resilience achieved through the National, International Standards-Class (NISC™), Better, Safer & More Efficient™ brand of Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow Commerce Systems; this technical document describes the history, principles, concepts and core processes necessary to increase your investment and business market opportunities in the hidden and lucrative and technical world of "private finance", in your role as either an 'investor, lender, intermediary or borrower'.

Finance Sector Industry Members: if you are a member of Top Management of a federally regulated financial institution (FRFI), provincial/state institution or public securities-reporting financial entity, learn - in confidence - the basic knowledge you need in order to properly introduce your trusting customers to the investment and borrowing opportunities found in Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow finance.

Regardless of your role: student, retail investor, Chief Executive Officer, government licensed and regulated mortgage broker; understand how 14 years of successful operation of the technology neutral MQCC System-Network™ is globally recognized as the defacto standard for quality (Better, Safer and more Efficient Trade™ ) in Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow finance because of over 12 years of continuous registration to the family of National and International Quality Management Standards ISO 9001. Specifically, ISO 9000:2000, ISO 9001:2008 and the current, risk-based ISO 9001:2015. ISO 9001 is a family of consensus-based standards trusted and adopted as the National Standard in least 119 countries, including members of the Group of 20, Digital 9 and World Trade Organization (WTO).

Legislators, Regulators, Legal Professionals, Consumers, Investors, Industry Members: discover how the MQCC System-Network™ instills regulatory confidence, prevents professional liability insurance claims through improved compliance using standards-based conformity systems, reduces consumer and investor risk, increase business revenues and increase investor-lender investment returns in the field of Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow finance; correctly defined as:

The trade in non-bank, non-institutional, non-syndicated, non-regulated or regulatory exempt, free trading securities and related financial instruments; also known as Peer-to-Peer (P2P)/Private/Crypto/Secret/Shadow securities and related financial instruments.

for the benefit of Canadian and International (in at least 119 countries):

<>Consumers (Borrowers, Investors-Lenders)

<>Government Regulated and Non-Regulated Credit Intermediaries

<>Professional Liability Errors and Omissions Risk Insurers

<>Regulators, Legislators, Policy Makers, Industry Groups and the General Public

@bitmortgages

All Management Systems Auditors are Accredited by or Members of

|

|

|

|

| Welcome to the Future of Finance™Where Quality Lives™ |

The MQCC™'s Business Enterprise Quality Management System is Registered to the Canadian Equivalent of ISO 9001:2015 published by:

Canada's National Standard for Quality Management ISO 9001:2015

CSA Group: "Helping improve the safety and quality of the products and services that touch your life." |

BITMORTGAGE® (bitmortgage.com) | BITCOIN™ (www.bitcoin.eco) |

Read the Textbooks & JournalsMQCC™ Educates World's Leaders & Top Management™Available at:Amazon BooksGoogle BooksIJCS™ International Journal of Conformity Science |

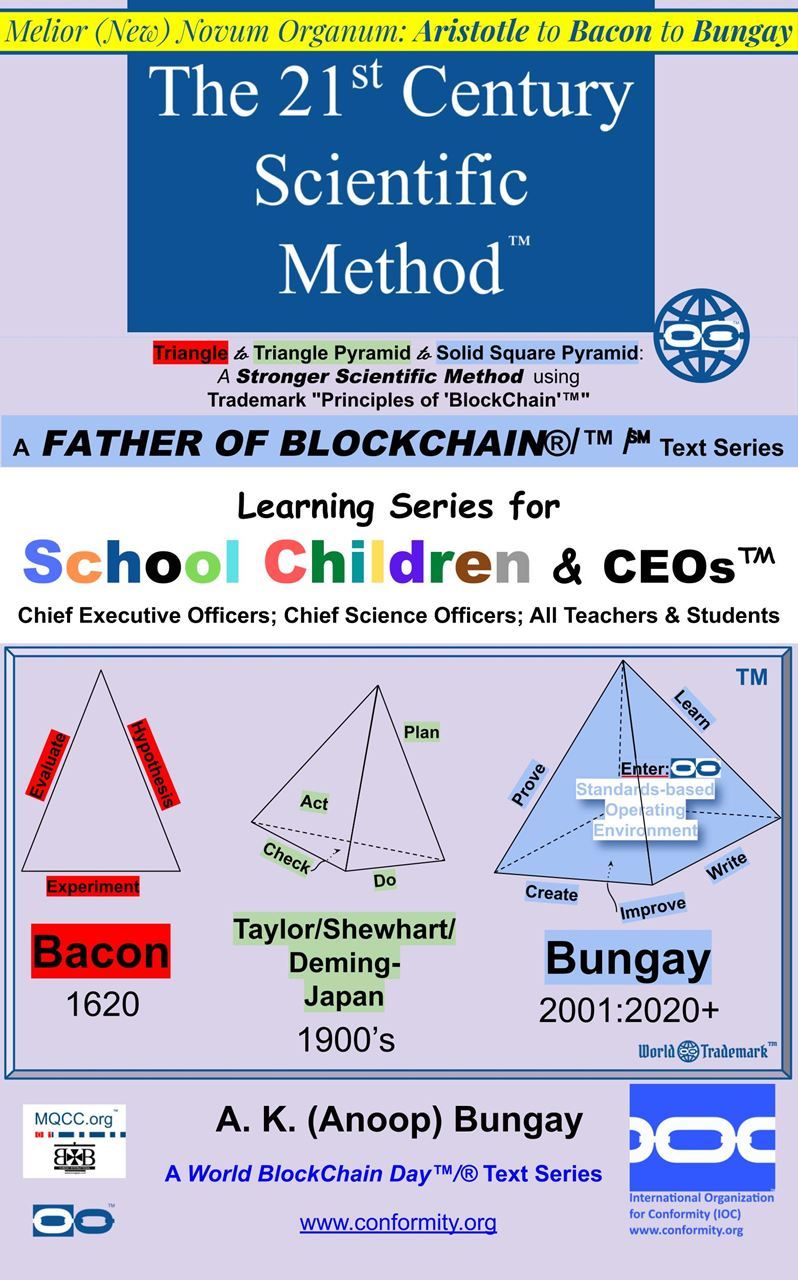

Be The Bank™/®; FATHER OF BLOCKCHAIN®; FATHER OF CRYPTO® Trademark Source Identifier Series & All MQCC Omnibus Series™ |

|

|

|

|  |

|

|

|

|

|

|

|

|

|  |

After reading all of the foregoing, ask yourself: Who would YOU trust your money with?

MQCC™: A new system, a new standard, a new benchmark in Canadian and global finance.

Yes, there is a "better way" to trust & confidence in Finance; the MQCC™ approach is your "better way".

The domain MQCC.org is the primary information page for the Meta Quality Conformity Control Organization, MQCC™ incorporated as MortgageQuote Canada Corp., headquartered in Calgary, Alberta, Canada and trading in up to 119 countries. MQCC™ is an organization classified by the United Nations (UN), Department of Economic and Social Affairs (DESA), Statistics Division (UNSD) International Standard Industrial Classification of All Economic Activities (Revision 4) involved in the following industry classification sections or classes:

- Section J (Information and communication)

- Section K (Financial and insurance activities

- Class 6492 > credit granting; money lending outside the banking system

- Class 6619 > activities auxiliary to financial service activities; activities of mortgage advisers and brokers

- Section M (Professional, scientific and technical activities) This section includes specialized professional, scientific and technical activities. These activities require a high degree of training, and make specialized knowledge and skills available to users

- Section N (Administrative and support service activities)

- Section P (Education)

- Section S (Other service activities)

The North American Industry Classification System (NAICS) equivalent classification to the UNSD Classes is:

- non-depository credit intermediary

- mortgage and non-mortgage loan brokers

Similar industry equivalencies exist in all countries who participate in the United Nations.

Subject to the jurisdiction, from a governance (statutory or regulatory) perspective, MortgageQuote Canada Corp. MQCC™ business activity, namely, real-estate-secured (mortgage) intermediary activity, are deemed to be:

- a regulated activity

- non-regulated activity

- regulatory exempt activity

- free trading activity

In its country of origin, Canada, MortgageQuote Canada Corp. MQCC™'s real-estate-secured (mortgage) intermediary activity is regulated by three provincial or territorial jurisdictions:

- Alberta - regulated by the Real Estate Council of Alberta (RECA)

- British Columbia - regulated by the British Columbia Financial Services Authority (BCFSA)

- Ontario - regulated by the Financial Services Regulatory Authority (FSRA fka FSCO) (FSRA #12279)

MortgageQuote Canada Corp. MQCC™ may trade in other Canadian provincial or territorial jurisdictions, subject to statutory or regulatory requirements or exemptions.

In Canada, education in private equity mortgage (PEM®) subject matter, competency and proficiency credentialing is an unregulated activity. Providing advice respective specific financial transactions, might be subject to regulatory oversight.

Canada Provincial Mortgage Broker Regulators: (RECA - Alberta)(FICOM - BC)(FSCO Ontario - Brokerage License #12279). Non-Canada Residents and international visitors, please read "Website Terms of Service", below. All items with a ® or ™ symbol or, some items in UPPER CASE are registered or unregistered (common law) trademarks of MortgageQuote Canada Corp. (MQCC™) or licensed by same. Some third party trademarks are used pursuant to nominative fair use principles. See Intellectual Propertyfor full details. Deconstruction of a Claim (Internal Use Only). MQCC™Data Artifacts, Privacy (PIPEDA), Data Security, Website Terms of Service, Legal, Disclosures: Statements, Consumer Electronic Message Preferences (CEMP). Meta Quality Conformity Control Organization is a registered or unregistered trademark of MortgageQuote Canada Corp. All MQCC Standards, Systems, Technologies, Products (goods) and Services (methods) conform to WFT™ MQCC™ "Principles of 'BlockChain'™" and is licensed by MQCC Bungay International LLC to assured the highest standard of control of the nature, quality and character of MQCC™ intellectual property.

MQCC™ is a member of the Worldwide WIZGOD™ trademark brand of global computer consulting government, industry and consumer services and MQCC™ is licensed or permitted to provide goods and services under the WIZGOD™ trademark brand.

*Accredited Class® Licenses are issued by MQCC Bungay International LLC or Bungay International Inc.

© 2006-2022+ Copyright and Trademark (design mark and word mark) MortgageQuote Canada Corp. MQCC™ "Proud Sponsor of the Canadian Dream"®. All rights reserved. An ISO 9001:2015 Registered Company.

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)

%20%20Ratio%20(62x51).png)

.png)

.jpg)

.jpg)

;%20Organizations%20and%20Individuals%20-%20Level%2001%20(Zero%20One_)%20High%20Level%20Introduction.jpg)