MortgageQuote Canada Corp. (mortgagequote.ca™)

Welcome to where the Future of Finance got its start.™

Home to the World's Official Mortgage Metaverse™ Trademark Brand of Goods and Services

MortgageQuote.Ca MQCC®: what over 15 Years of Global, Regulatory-Integrated, Commercialized "BlockChain™" is:

April 9, 2005 - 2020

Are you looking for a financial services organization that is certified to both Canada and USA Federal Government National Standards & International Standards to be "Safe, Reliable and Good"? Since 2006, there's only one in Canada and you have found them.

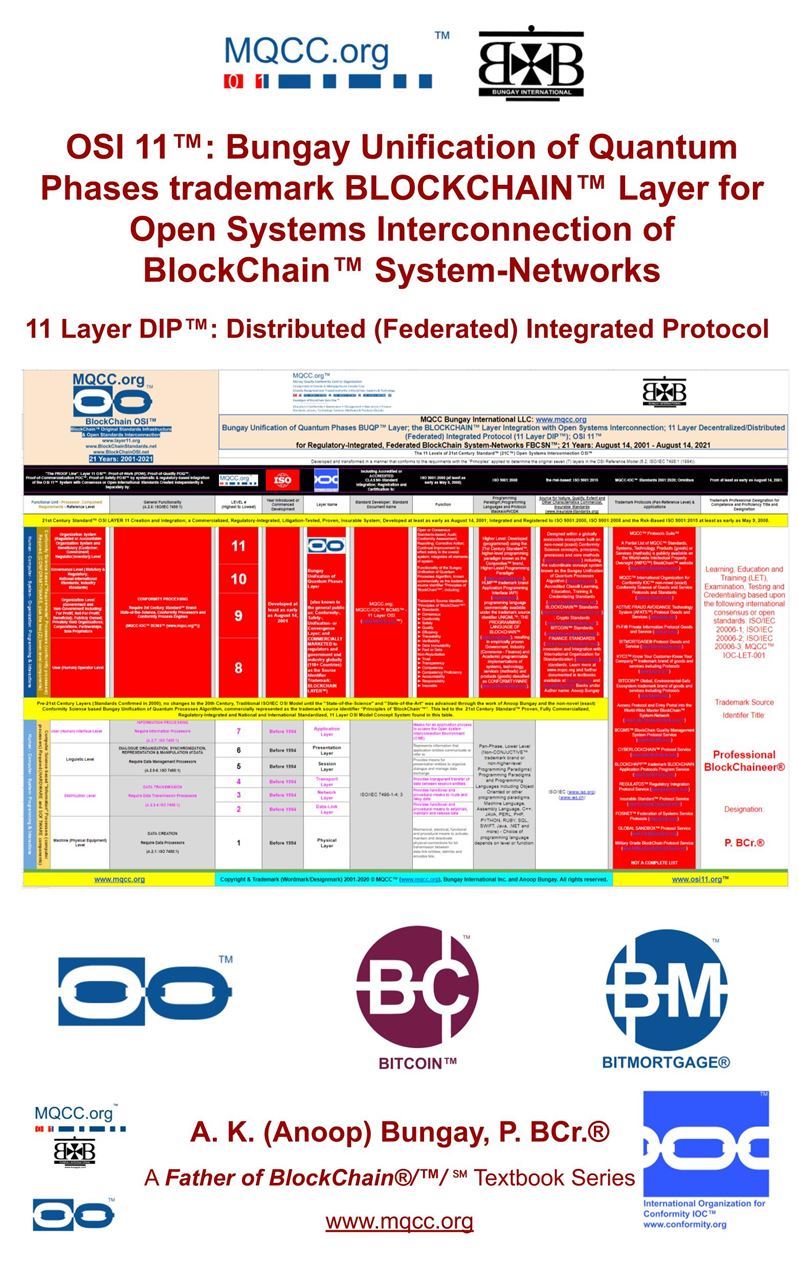

MortgageQuote Canada Corp. (mortgagequote.ca) is the only Canada-based, global finance sector firm whose risk-based unified Quality Management System (uQMS™) - uses (under license) the MQCC Suite™ (www.mqcc.org) of systems, technology, services and products; built from the ground up using the "Principles of 'BlockChain'", "proof-of-work" and "proof-of-quality" protocols - is registered to meet the rigorous 'National Standard of Canada' for Quality Management, published by the CSA Group (Canadian Standards Association). The Standard is trusted by Canadians and recognized by over 119 countries including USA, UK & AU.

According to the Standards Council of Canada (SCC), a Canadian federal Crown corporation which reports to Canadian Parliament through the Minister of Innovation, Science and Economic Development Canada: Standards help to ensure BETTER, SAFER and MORE EFFICIENT methods and products, and are an essential element of technology, innovation and trade.

In accordance with the Government of Canada’s Cabinet Directive on Regulatory Management, the National Standard of Canada for Quality Management is adopted from world-class international standards, namely, the quality management system standard ISO 9001, published by the International Organization for Standardization (ISO) [based in Switzerland], of which Canada is a founding member.

Since 2008, no other Canadian Bank, Financial Institution, Lender, Fiduciary and Non-Fiduciary Investment Advisor/Broker and Financial Technology Company is able to make this claim. As a consumer, investor, regulator or stakeholder in Canada's finance sector, given today's market conditions in the finance sector, we trust you agree that it's a claim worth making.

Visit www.mqcc.org to learn about the Money Quality Conformity Control Organization and its history.

BUILT ON METAVERSE™

Home to the "MESSAGES FROM THE METAVERSE™" trademark brand of wealth management financial services; as seen on METAVERSEPEDIA™. Federal National Standards of Quality Managed, Low Risk financial solutions for investors and creative financial solutions for borrowers or investment seekers, built on principles of conformity science.

Standards Organization Hierarchy in Canada & Select International Peers

International Standards Body:

|

| Founding National Member of ISO:

|

|

| Standards Council of Canada (SCC) is the Secretariat for the ISO/Technical Committee #176: Quality management and quality assurance. SCC is a Canadian Crown corporation established by an Act of Parliament in 1970 to foster and promote voluntary standardization in Canada. |

| On behalf of Standards Council of Canada (SCC), CSA Group manage the global administrative, record-keeping and correspondence requirements of the ISO 9001 and ISO 14001 standards. |

Trusted Canadian & Global Industry Sector Leaders with MQCC Equivalent Standard Quality Management Systems Certification |

.png)

.jpg)

.png)

.png)

Incorporated in 2006, with over a decade of experience, you have not seen a company like MortgageQuote Canada Corp. (mortgagequote.ca) in Canada's finance sector before, because it has not existed before.

Incorporated in 2006, with over a decade of experience, you have not seen a company like MortgageQuote Canada Corp. (mortgagequote.ca) in Canada's finance sector before, because it has not existed before.

.png)

.png)

.png)

.png)

.png)

%20%20Ratio%20(62x51).png)

.png)

.jpg)

.jpg)

;%20Organizations%20and%20Individuals%20-%20Level%2001%20(Zero%20One_)%20High%20Level%20Introduction.jpg)