.png)

To learn how MQCC does what it does, first register @ login.mortgagequote.ca

Four (4) simple ways to learn 'how':

* Borrower - apply to borrow money from MQCC @ www.mortgagequote.ca

* Invest - apply to invest money with MQCC @ investor.mortgagequote.ca

* Refer - apply to refer business to MQCC @ referrals.mortgagequote.ca

* Enroll in one of MQCC's Academic, Vocational or Investor-grade Education programs @ edu.mqcc.org

The MQCC™'s Business Enterprise Quality Management System is Registered to the Canadian Equivalent of ISO 9001:2015 published by:

Canada's National Standard for Quality Management ISO 9001:2015

CSA Group: "Helping improve the safety and quality of the products and services that touch your life." |

BITMORTGAGE® (bitmortgage.com) | BITCOIN™ (www.bitcoin.eco) |

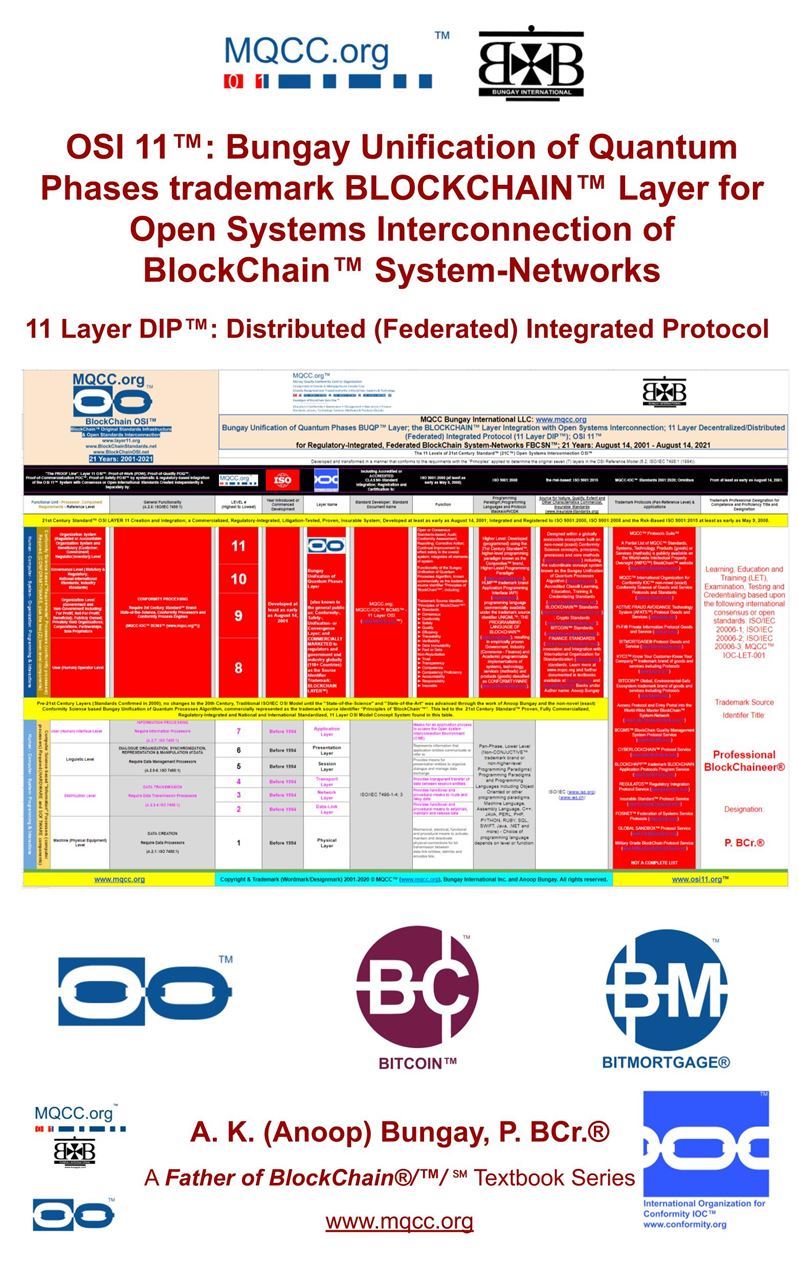

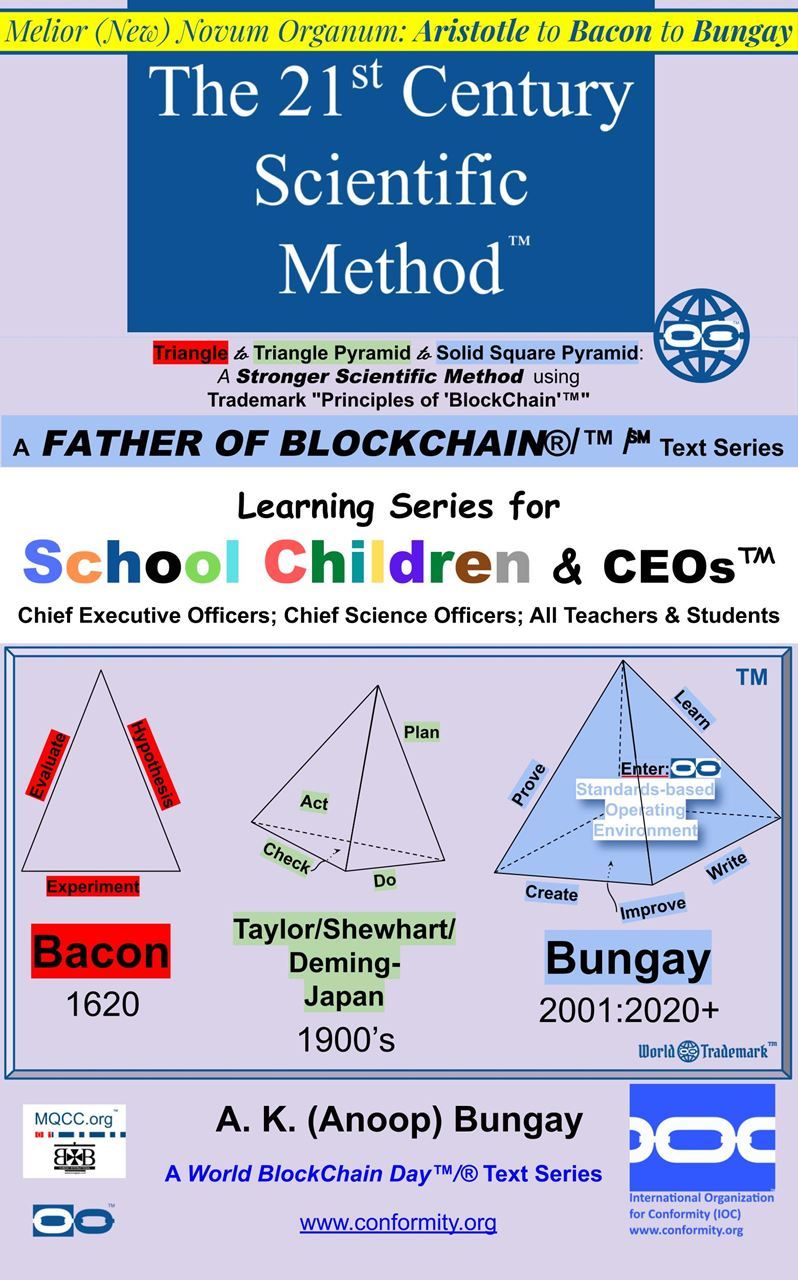

Read the Textbooks & JournalsMQCC™ Educates World's Leaders & Top Management™Available at:Amazon BooksGoogle BooksIJCS™ International Journal of Conformity Science |

Be The Bank™/®; FATHER OF BLOCKCHAIN®; FATHER OF CRYPTO® Trademark Source Identifier Series & All MQCC Omnibus Series™ |

|

|

|

|  |

|

|

|

|

|

|

|

|

|  |

After reading all of the foregoing, ask yourself: Who would YOU trust your money with?

MQCC™: A new system, a new standard, a new benchmark in Canadian and global finance.

Yes, there is a "better way" to trust & confidence in Finance; the MQCC™ approach is your "better way".

The domain MQCC.org is the primary information page for the Meta Quality Conformity Control Organization, MQCC™ incorporated as MortgageQuote Canada Corp., headquartered in Calgary, Alberta, Canada and trading in up to 119 countries. MQCC™ is an organization classified by the United Nations (UN), Department of Economic and Social Affairs (DESA), Statistics Division (UNSD) International Standard Industrial Classification of All Economic Activities (Revision 4) involved in the following industry classification sections or classes:

- Section J (Information and communication)

- Section K (Financial and insurance activities

- Class 6492 > credit granting; money lending outside the banking system

- Class 6619 > activities auxiliary to financial service activities; activities of mortgage advisers and brokers

- Section M (Professional, scientific and technical activities) This section includes specialized professional, scientific and technical activities. These activities require a high degree of training, and make specialized knowledge and skills available to users

- Section N (Administrative and support service activities)

- Section P (Education)

- Section S (Other service activities)

The North American Industry Classification System (NAICS) equivalent classification to the UNSD Classes is:

- non-depository credit intermediary

- mortgage and non-mortgage loan brokers

Similar industry equivalencies exist in all countries who participate in the United Nations.

Subject to the jurisdiction, from a governance (statutory or regulatory) perspective, MortgageQuote Canada Corp. MQCC™ business activity, namely, real-estate-secured (mortgage) intermediary activity, are deemed to be:

- a regulated activity

- non-regulated activity

- regulatory exempt activity

- free trading activity

In its country of origin, Canada, MortgageQuote Canada Corp. MQCC™'s real-estate-secured (mortgage) intermediary activity is regulated by three provincial or territorial jurisdictions:

- Alberta - regulated by the Real Estate Council of Alberta (RECA)

- British Columbia - regulated by the British Columbia Financial Services Authority (BCFSA)

- Ontario - regulated by the Financial Services Regulatory Authority (FSRA fka FSCO) (FSRA #12279)

MortgageQuote Canada Corp. MQCC™ may trade in other Canadian provincial or territorial jurisdictions, subject to statutory or regulatory requirements or exemptions.

In Canada, education in private equity mortgage (PEM®) subject matter, competency and proficiency credentialing is an unregulated activity. Providing advice respective specific financial transactions, might be subject to regulatory oversight.

Canada Provincial Mortgage Broker Regulators: (RECA - Alberta)(FICOM - BC)(FSCO Ontario - Brokerage License #12279). Non-Canada Residents and international visitors, please read "Website Terms of Service", below. All items with a ® or ™ symbol or, some items in UPPER CASE are registered or unregistered (common law) trademarks of MortgageQuote Canada Corp. (MQCC™) or licensed by same. Some third party trademarks are used pursuant to nominative fair use principles. See Intellectual Propertyfor full details. Deconstruction of a Claim (Internal Use Only). MQCC™Data Artifacts, Privacy (PIPEDA), Data Security, Website Terms of Service, Legal, Disclosures: Statements, Consumer Electronic Message Preferences (CEMP). Meta Quality Conformity Control Organization is a registered or unregistered trademark of MortgageQuote Canada Corp. All MQCC Standards, Systems, Technologies, Products (goods) and Services (methods) conform to WFT™ MQCC™ "Principles of 'BlockChain'™" and is licensed by MQCC Bungay International LLC to assured the highest standard of control of the nature, quality and character of MQCC™ intellectual property.

MQCC™ is a member of the Worldwide WIZGOD™ trademark brand of global computer consulting government, industry and consumer services and MQCC™ is licensed or permitted to provide goods and services under the WIZGOD™ trademark brand.

*Accredited Class® Licenses are issued by MQCC Bungay International LLC or Bungay International Inc.

© 2006-2022+ Copyright and Trademark (design mark and word mark) MortgageQuote Canada Corp. MQCC™ "Proud Sponsor of the Canadian Dream"®. All rights reserved. An ISO 9001:2015 Registered Company.

.png)

.png)

.png)

.png)

.png)

%20%20Ratio%20(62x51).png)

.png)

.jpg)

.jpg)

;%20Organizations%20and%20Individuals%20-%20Level%2001%20(Zero%20One_)%20High%20Level%20Introduction.jpg)